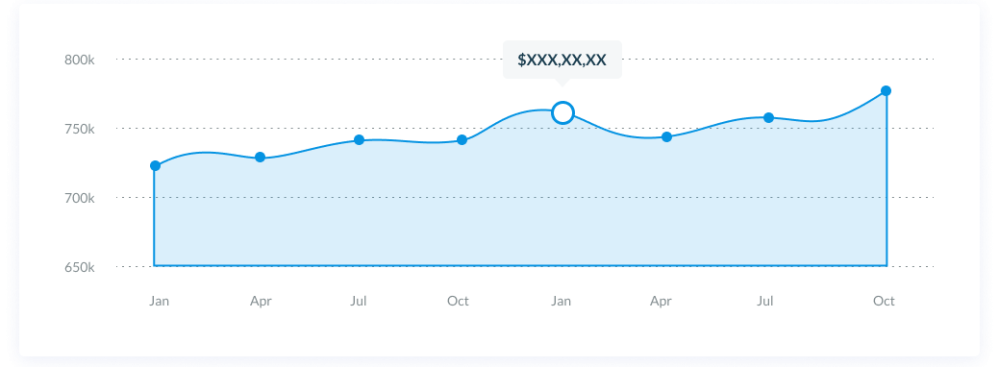

What's your home worth?

Your home’s value is approximately

$ XXX,XXX

The amount of equity you have in your home is:

This is how much you would make if you sold your home today.

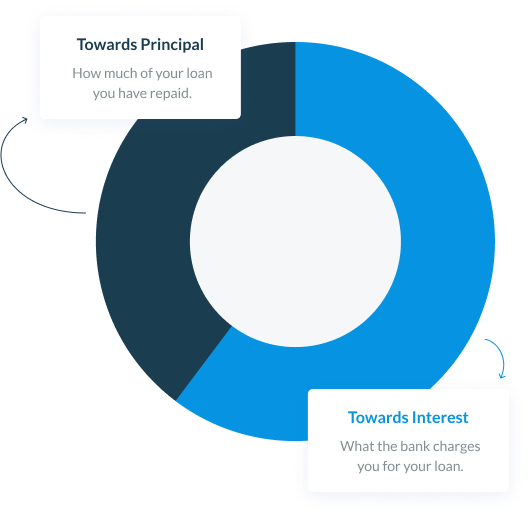

Your Mortgage, Unpacked.

Interest Adds up

Your 30 year loan could mean $ xxxxx in interest — but it doesn’t have to. Learn how to pay down your principal quicker and start saving on interest today!

What Could You Save by Refinancing?

Rates shown below are for example purposes only:

15 Year

3.5% Rate - 3.624% APR

Long term savings

payment goes up by $xxxx/month

25 Year

3.75% Rate - 3.894% APR

Long term savings

payment goes up by $xxxx/month

30 Year

3.875% Rate - 3.993% APR

Long term savings

payment goes up by $xxxx/month

3.5% Rate - 3.624% APR

Long term savings

payment goes up by $xxxx/month

3.75% Rate - 3.894% APR

Long term savings

payment goes up by $xxxx/month

3.875% Rate - 3.993% APR

Long term savings

payment goes up by $xxxx/month

Your Goals.

Your Moving Strategy.

Want to continue building wealth during your next move? We’re here to help unravel the complexities of buying: Do you rent and buy? Sell and buy? Refinance and invest? The right strategy could help you get the most out of your home equity. Not sure where to start? No worries, we’ll guide you through it.